Understanding EPFO’s Standard Operating Procedure: A Guide to the Joint Declaration Form for Correction in EPF Records

Discover the EPFO’s Standard Operating Procedure for correcting EPF records with the Joint Declaration Form. Viriksha HR Solution guides you through the process to ensure accuracy in your financial future.

In the realm of employee welfare and financial security, the Employees’ Provident Fund (EPF) stands as a cornerstone for millions of workers across India, offering a safety net for the future. However, discrepancies in EPF records can often pose challenges for both employees and employers. Recognizing this, the Employees’ Provident Fund Organization (EPFO) has streamlined the process for correcting such discrepancies through the Joint Declaration Form. Viriksha HR Solution, as your trusted HR partner, delves into the Standard Operating Procedure (SOP) set forth by the EPFO, aiming to demystify the process and ensure your records are accurate and up-to-date.

The Essence of the Joint Declaration Form

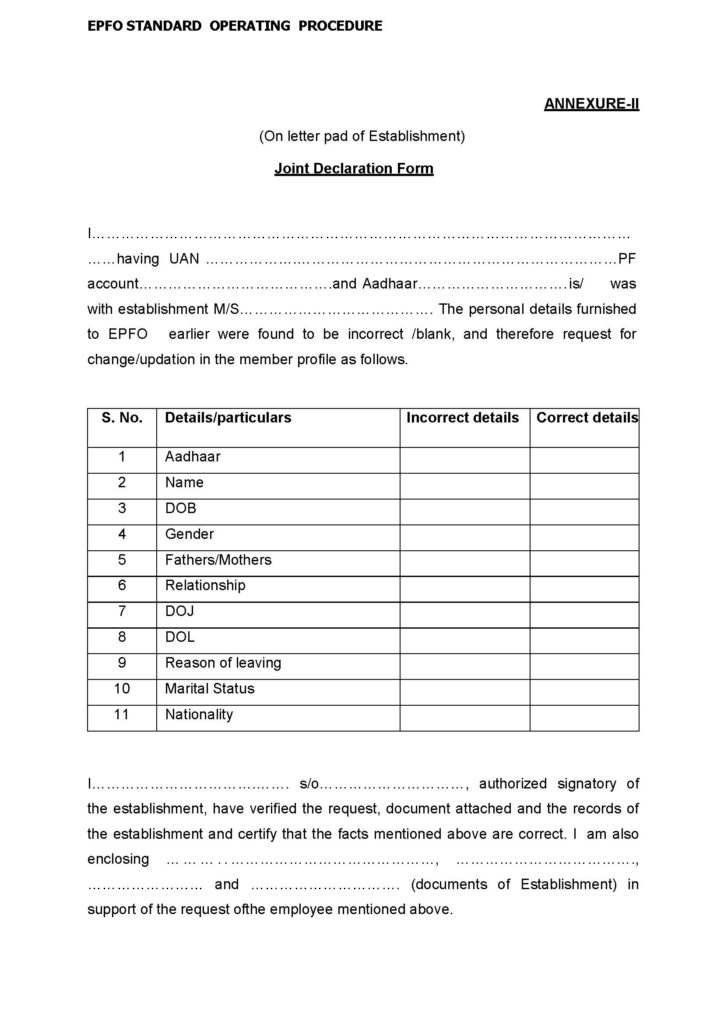

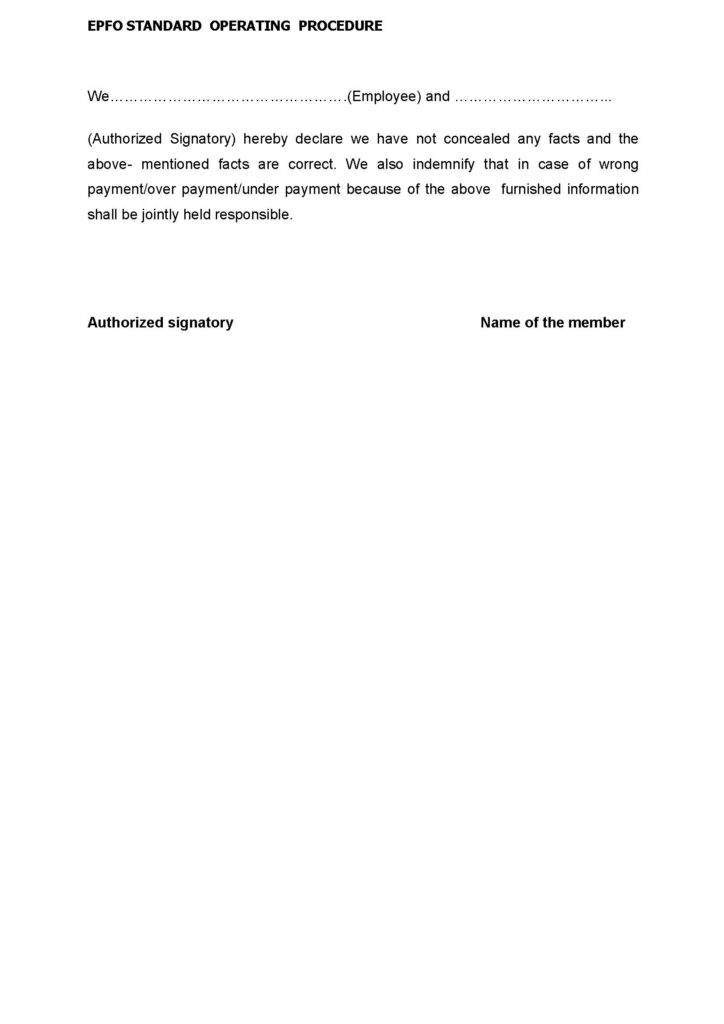

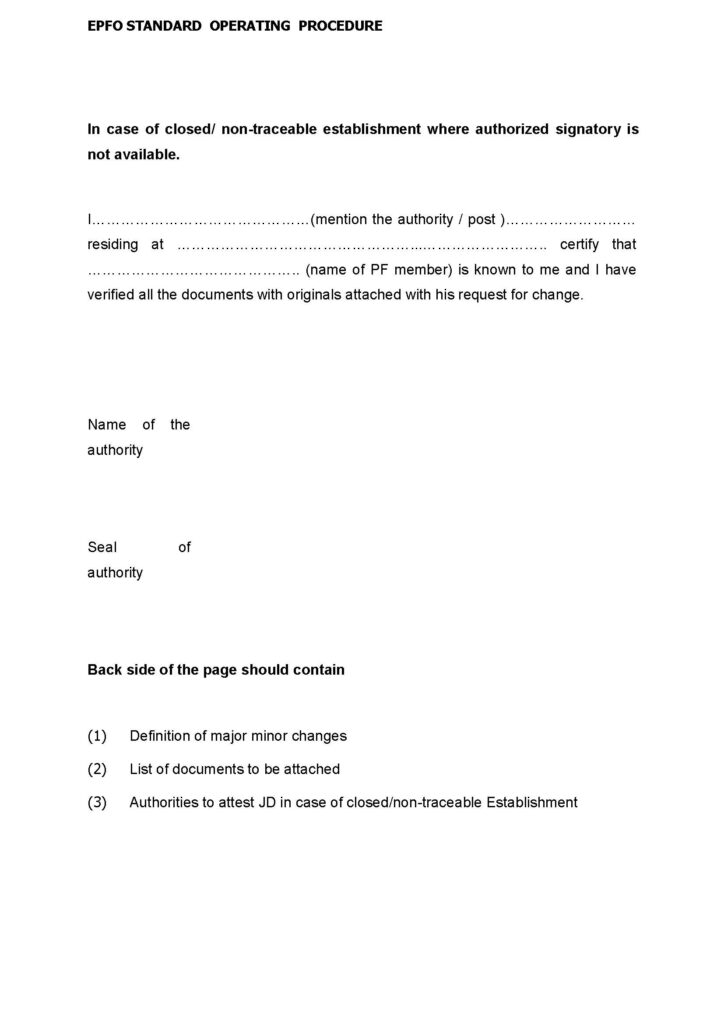

The Joint Declaration Form is a vital document used to rectify any errors in an employee’s EPF records, such as discrepancies in the employee’s name, date of birth, or other personal details. It requires the joint submission by both the employee and the employer, underscoring the collaborative effort needed to ensure the accuracy of EPF records.

Navigating the Correction Process

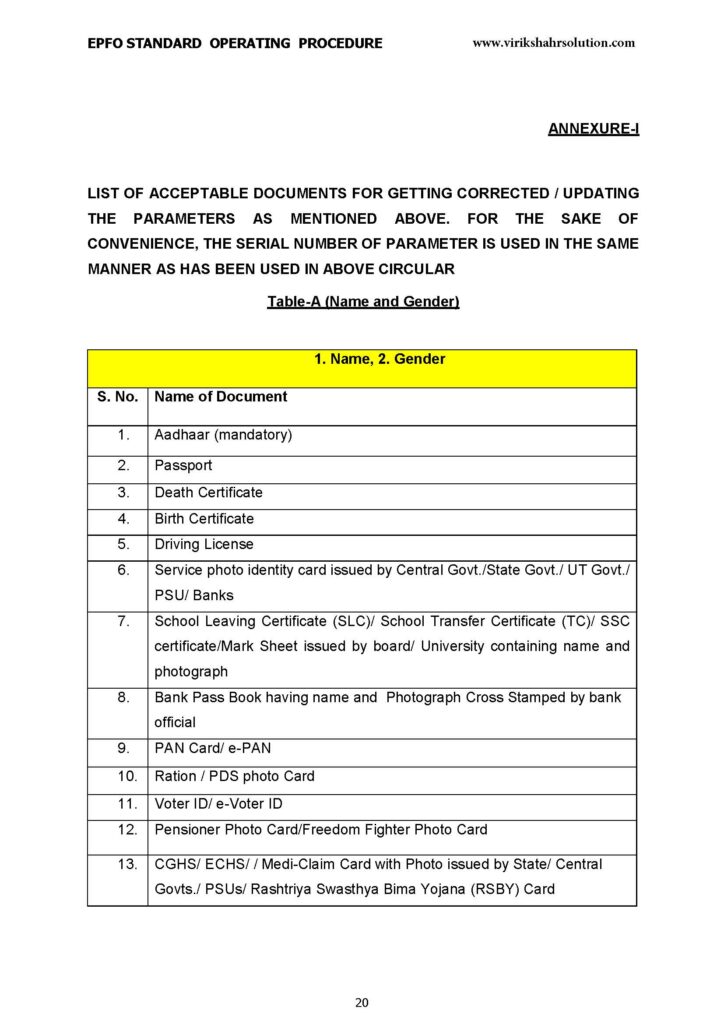

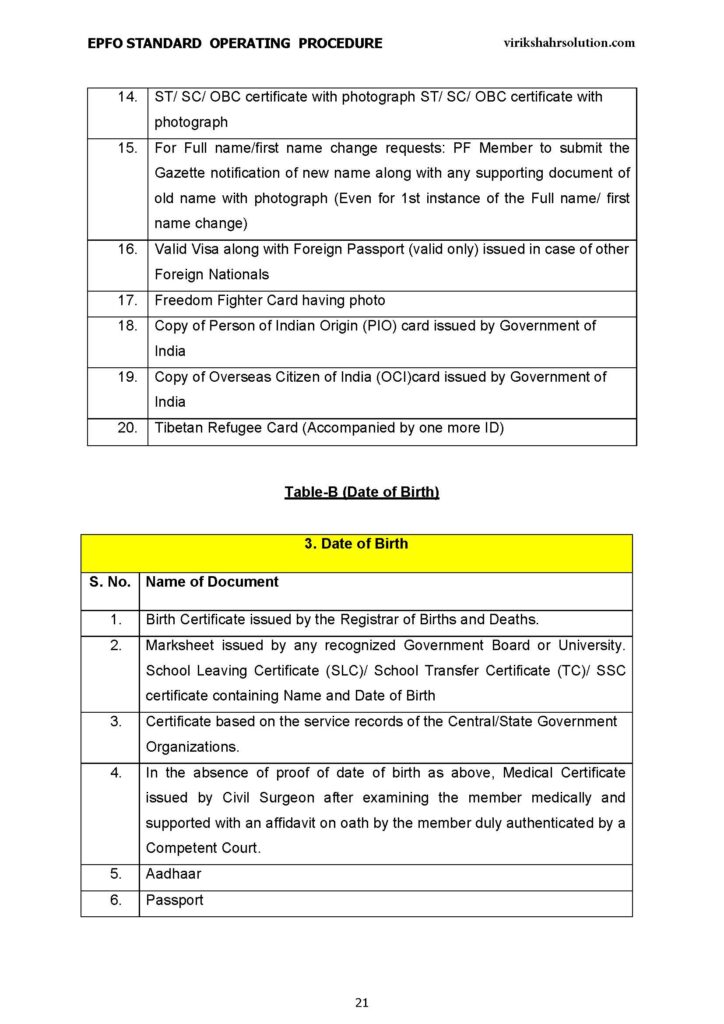

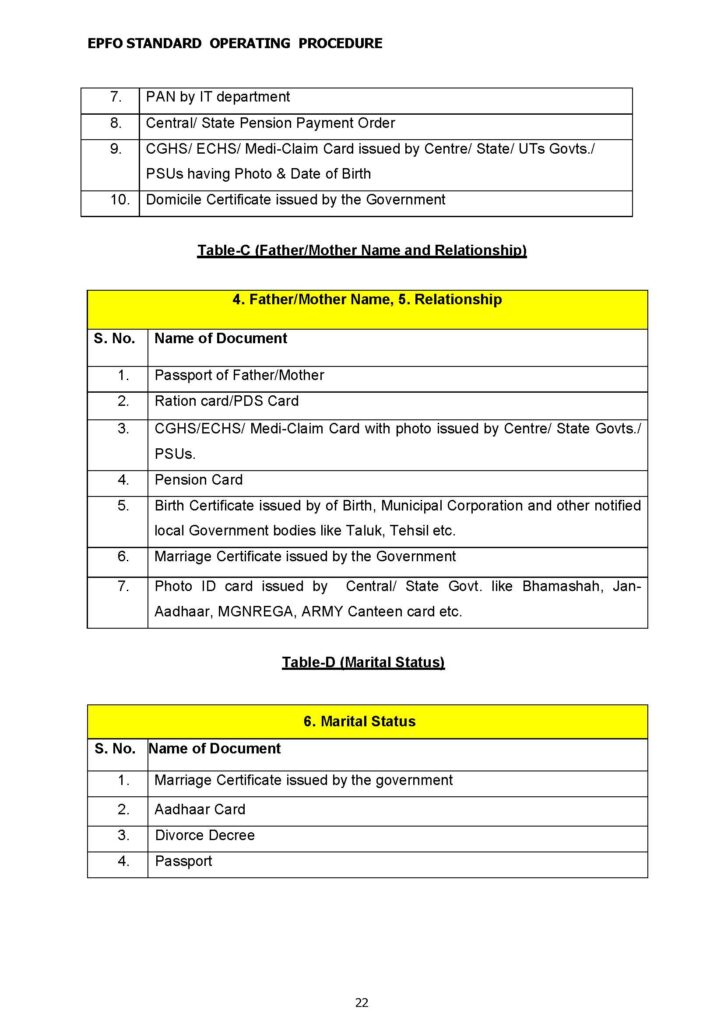

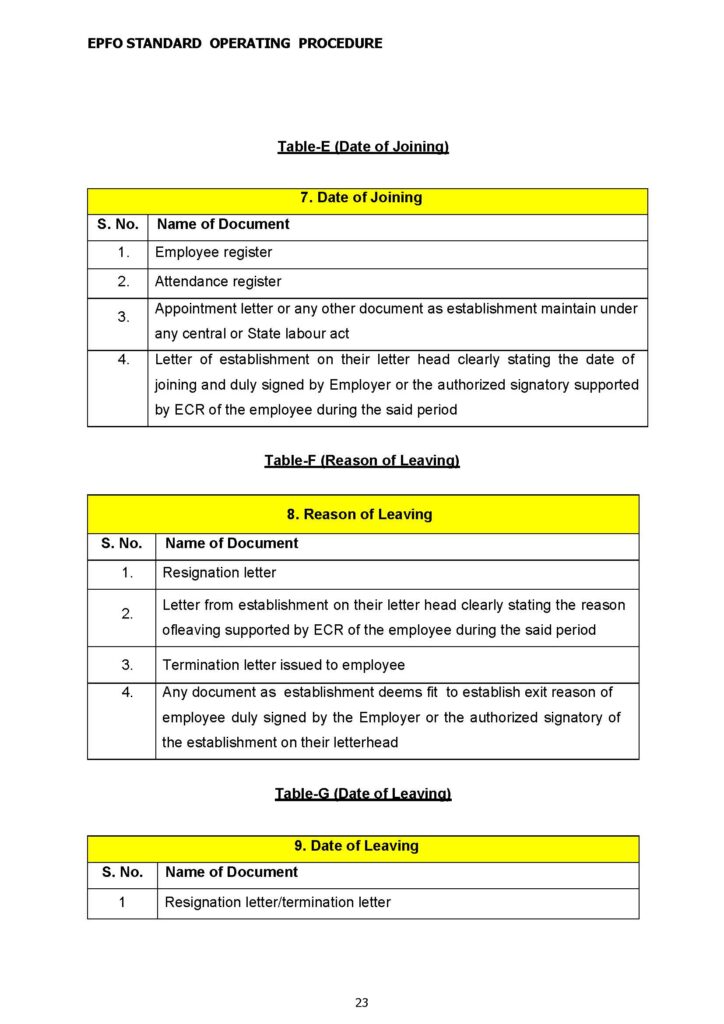

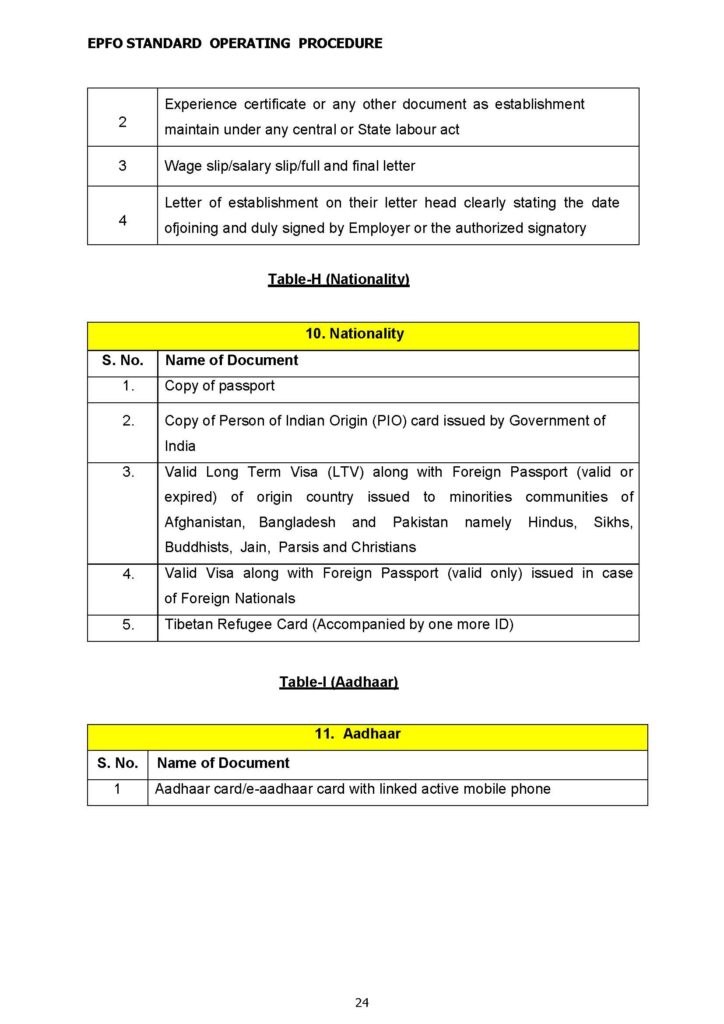

The correction process involves several key steps, initiated by accurately filling out the Joint Declaration Form. This form must then be submitted to the respective EPFO office, accompanied by supporting documents that substantiate the requested changes. It’s a process that demands attention to detail and a thorough understanding of the required documentation.

How Viriksha HR Solution Can Assist

At Viriksha HR Solution, we understand the nuances of EPF corrections and are equipped to guide both employers and employees through the process. Our expertise ensures that your Joint Declaration Forms are filled out accurately and submitted properly, minimizing delays and ensuring your peace of mind.

Importance of Timely Corrections

Timely correction of EPF records is crucial. Discrepancies in records can lead to complications during the withdrawal or transfer of EPF funds, potentially affecting an employee’s financial planning for the future. By adhering to the SOP and ensuring accurate records, you safeguard your financial interests and ensure compliance with regulatory mandates.

Visit Our Website

For a more detailed guide on filling out the Joint Declaration Form and navigating the EPF correction process, visit our website at Viriksha HR Solution. Our comprehensive resources and expert advice are designed to assist you at every step of the process.